Grow Your Crypto with ease

Don't keep your crypto idle, sit back and watch it grow with Hivestak.

We work with only audited protocols

Supported tokens

How It Works

Start staking in 3 simple steps and grow your crypto effortlessly

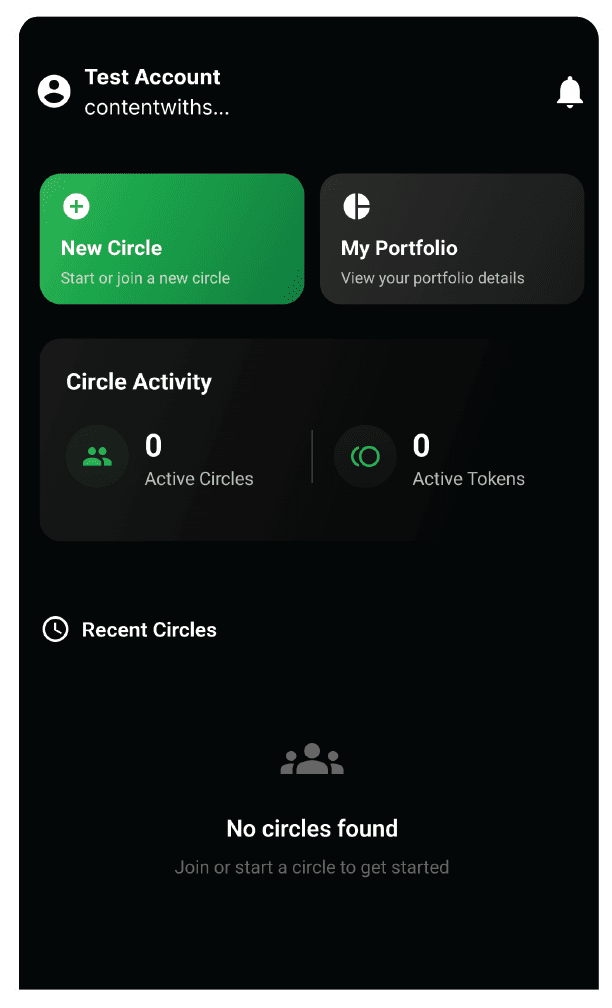

Start a New Circle

Start a new circle to get started.

Get started in minutes

Choose Your Token Type

Select from our supported tokens, including stable coins or crypto.

Supported: USDT, USDC, ETH, DAI, BNB, XRP

Select Growth Strategy

Pick a strategy that matches your preferred risk level and make your deposit

Your crypto, your choice

Join and Grow On-Chain

Join the circle and watch your crypto grow on-chain.

Start Earning Immediately

Why Choose Hivestak

Our platform is designed with security, transparency, and community in mind

Higher Yield

Boost your earnings with group-based growth. Unlock premium yield tiers on top protocols and grow your crypto faster with Hivestak's collective power.

Security

Grow with confidence. Your data is fully encrypted, private keys stay off-device, and our battle-tested smart contracts work with trusted, audited protocols.

Transparency

See every move on the blockchain. Hivestak ensures all smart contract actions are fully visible, so you're always in the know about your portfolio.

Easy to Use

Start growing in just three simple steps. Hivestak's user-friendly interface makes growing your crypto effortless, even if you're new to crypto.

Community

Join a thriving community of stakers. Connect in circles, share strategies, and get the latest growth tips on our Telegram—Hivestak grows with you.

Private & Secure

Keep full control of your funds. Hivestak's smart contract security ensures your assets are always safe, with no compromises on privacy.

Growth Strategies

Choose the strategy that aligns with your goals and risk tolerance

DeFi Lending

Lend your crypto to DeFi protocols and earn interest on your assets.

Key Benefits

- Earn money just by lending your crypto—no extra work needed!

- Works with many trusted lending platforms.

- Your earnings grow automatically over time.

- Start with any amount, big or small.

- Take your money out whenever you want, hassle-free.

Strategy Details

Expected APR

3-8%

Risk Level

Low

Lock Period

None

Frequently Asked Questions

Get answers to the most common questions about growing your crypto with Hivestak

How does Hivestak actually grow my crypto?

Hivestak connects your assets to top-performing DeFi protocols through smart contracts. We aggregate funds to access premium yield tiers, automatically compound returns, and optimize for the highest yields while maintaining your selected risk profile.

Is my crypto safe with Hivestak?

Absolutely, your crypto is in trusted hands with Hivestak! We operate a custodial platform, similar to trusted industry leaders like Binance, which means we securely manage your assets on our platform to provide you with a seamless and hassle-free experience. Your funds are protected by robust security measures, including industry-leading encryption, regular security audits, and integration with battle-tested protocols with proven track records.

What kind of returns can I expect?

Returns vary based on your chosen strategy and market conditions. Our lending strategy typically yields 3-8% APR, staking 5-12%, yield farming 8-20%, and liquidity providing 10-25%. These rates adjust with market conditions, but our collective approach consistently outperforms individual staking.

How do I get started with Hivestak?

Getting started takes just minutes. Connect your wallet, choose your preferred tokens (ETH, USDT, USDC, DAI, BNB, or XRP), select a growth strategy that matches your risk tolerance, and join a circle. Your assets will immediately begin earning returns on-chain.

How quickly can I withdraw my funds?

Withdrawal times depend on your chosen strategy. Lending and liquidity providing strategies allow immediate withdrawals. Staking typically has a 7-30 day unbonding period, while yield farming varies by protocol. All withdrawal timeframes are clearly displayed before you commit your assets. You'll only be charged a $1.75 flat fee upon withdrawal, with no additional percentage fees, and our optimized gas fees ensure the lowest transaction costs for seamless instant transfers.

Which tokens does Hivestak support?

We currently support ETH, USDT, USDC, DAI, BNB, and XRP across all our strategies. Each token has different yield opportunities based on market conditions. We're continuously expanding our supported assets based on security audits and community demand.

What are the risks involved?

While we prioritize security, all DeFi activities carry some risk. These include smart contract risk (mitigated through audits), market volatility, and protocol-specific risks. Our strategies are categorized by risk level, and we provide transparent risk assessments for each option so you can make informed decisions.

Still have questions?

Check out our comprehensive FAQ section or reach out to our community for support.